are political donations tax deductible uk

Is donation to political party tax deductible. A donation to a federal state or.

How Anyone Can Get A 2021 Tax Deduction Charitable Donations

This is called tax relief.

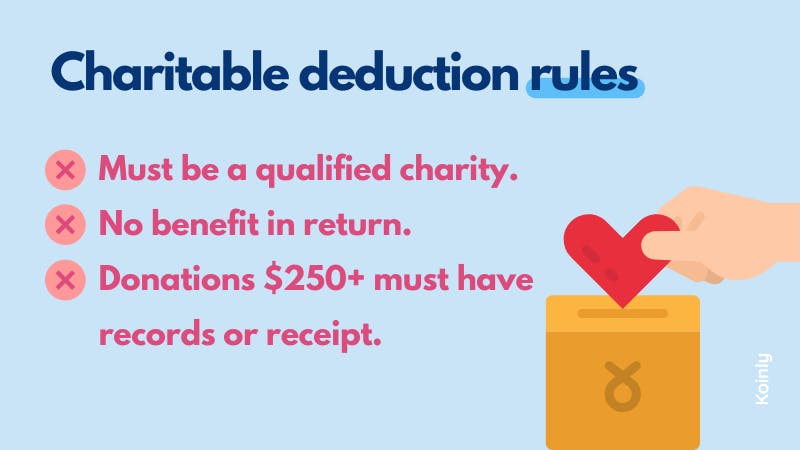

. Are charitable donations tax deductible for 2020. You can get tax relief if you donate. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your.

Donations by individuals to charity or to community amateur sports clubs CASCs are tax free. Subscriptions for general charitable purposes and those to for example political parties are. While charitable donations are generally 75 of contributions up to 100.

These business contributions to the political organizations are not tax-deductible just like the individual. Equipment or trading stock items it makes or sells land property or shares in another. Political donations are not tax deductible on federal returns.

S341 Income Tax Trading and Other Income Act 2005 S541 Corporation Tax Act 2009. According to the IRS. Straight from your wages or pension through Payroll.

A business tax deduction is valid only for charitable donations. Zee March 2 2022 Uncategorized No Comments. However there are still ways to donate and plenty of people have been taking advantage of them over the past.

Are Donations to Political Campaigns Tax Deductible. To be precise the answer to this question is simply no. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

Also donations not money such as goods services effort and time. Among those not liable for tax deductions are political campaign donations. These donations are not tax deductible.

Facebook marketplace dump trucks for sale near me x different symbols in probability x different symbols in probability. Things To Know. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible.

If you are not tax exempt and contributed charitable donations to a qualified organization you could claim a tax deduction. In other words you have an opportunity to donate to your candidate. However in-kind donations of.

In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20 30 or 50 depending. The simple answer to whether or not political donations are tax deductible is no. The IRS has clarified tax-deductible assets.

How this works depends on whether. Your limited company pays less Corporation Tax when it gives the following to charity. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible.

Are political donations tax deductible uk. Regardless of what type of political donation it is the IRS does not take it into account for deductions. Tax relief Donations to charity from individuals are tax free.

The tax goes to you or the charity. To put it another way financial.

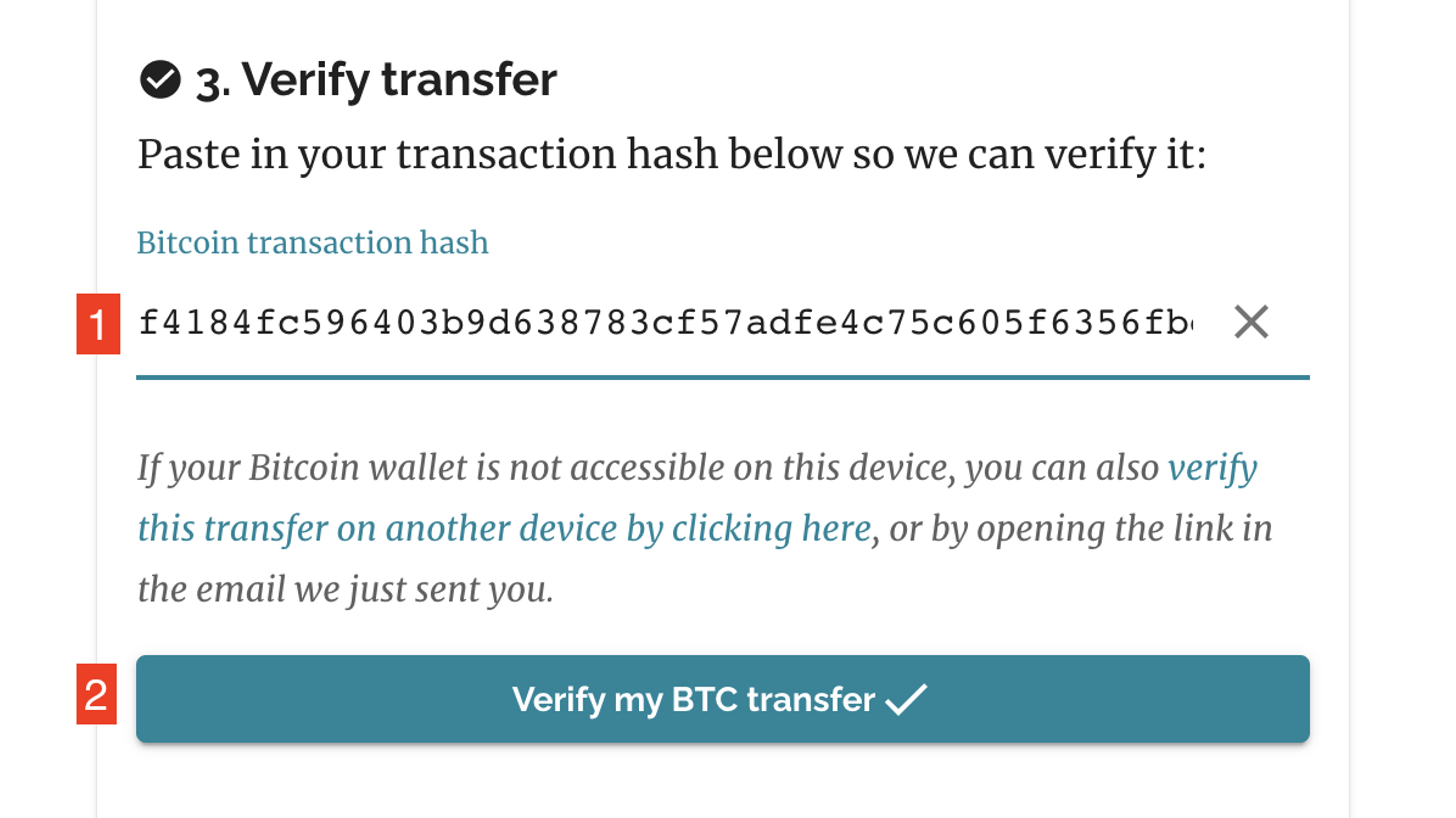

Donate Crypto And Lower Your Tax Bill Koinly

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

A Quick Guide To Deducting Your Donations Charity Navigator

Are Political Contributions Tax Deductible Smartasset

How Billionaires Get Big Charity Tax Breaks Then Delay Giving Bloomberg

Nonprofit Tax Programs Around The World Eu Uk Us

Updated Guide On Donations And Gifts Tax Deductions

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

What Are The Rules For Donating To Uk Political Parties Party Funding The Guardian

The Irs Donation Limit What Is The Maximum You Can Deduct

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Best Tips For Business Donations To Charity Wsi

Common Tax Issues Associated With Making Donations Wolters Kluwer

Tax Exiles Are Funnelling Money Into Our Political Parties It S Time To Close The Loophole Electoral Reform Society Ers

Why Should We Donate Money To Charity Giving What We Can

Frequently Asked Questions Giving What We Can

Tax Relief For Charitable Donations

Write Off Your Marketing Expenses And Save Money On Your Taxes